For financial institutions, who deal with sensitive customer information on a daily basis, data integrity is of the utmost importance. Data integrity ensures the accuracy, completeness, and consistency of data. It encompasses regulatory compliance and security measures to guarantee the security of your data. Maintaining data integrity ensures that the information stored in your database is reliable, accurate, and complete, regardless of how long it is stored or how frequently it is accessed.

Hyarchis’ Data Integrity is a crucial part of the Know Your Customer (KYC) lifecycle management process. It’s an advanced information management solution that uses AI technology to automate quality control procedures. Data Integrity performs a comprehensive analysis of customer files, verifies the completeness and accuracy of each file, and ensures that documents are correctly placed within the corresponding customer file. By minimizing the risk of data mishandling, Data Integrity helps to ensure regulatory compliance and protect sensitive information.

What are the benefits of Data Integrity?

Hyarchis Data Integrity is an advanced solution that revolutionizes the way you handle your customer data. Let’s take a look at the main benefits of Hyarchis Data Integrity:

- Ensure compliance with regulatory requirements. Data integrity helps you comply with regulatory requirements, such as GDPR, by ensuring the safety of your data in terms of both compliance and security.

- Accurate quality control. With data integrity, you can automate your quality control procedures, making the process faster, more thorough, and more accurate.

- Suitable for unstructured documents. Data integrity is suitable for unstructured documents of any file type, which means you can use it to manage and organize all your data, regardless of how it’s stored.

- Applicable to brand-new and historic documents. Data integrity is particularly beneficial for financial institutions, as it helps to ensure that their records are accurate and reliable, whether they are working with newly created documents or historical records.

- Continuously improving AI-based technology. This means that the application can adapt and evolve over time to better meet the changing needs and demands of the organization. This ensures that the quality control procedures remain effective and efficient in the long term.

- And it’s safe. Data Integrity complies with ISO 27001, ISO 27018 and SOC 2 Type 2 security standards, ensuring that sensitive information is always properly protected.

What can you use Data Integrity for?

Hyarchis Data Integrity guarantees the accuracy, completeness, and consistency of customer data across multiple systems, thereby mitigating the risk of data leaks. This feature offers a comprehensive solution for ensuring customer data is error-free and aligned across various systems, enabling organizations to maintain the highest levels of data integrity.

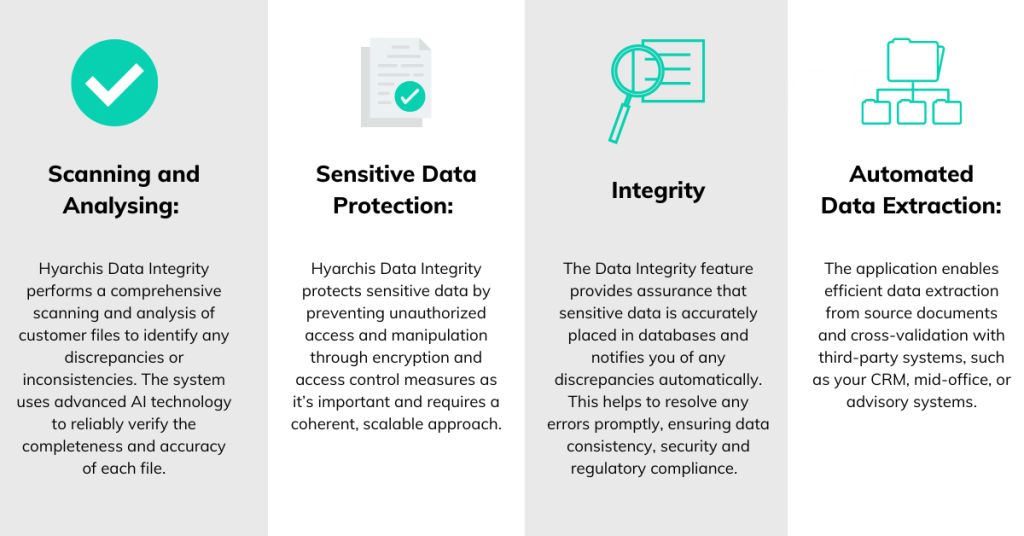

What Hyarchis Data Integrity brings to your data:

Conclusion

By prioritizing data integrity, financial institutions can safeguard their data against external malicious forces and internal mistakes, and protect against data loss or leaks. Implementing data validation and error-checking measures can prevent sensitive data from being miscategorized or stored incorrectly, minimizing the risk of potential breaches.

Hyarchis Data Integrity provides accurate quality control, regulatory compliance, and continuous improvement, making it ideal for managing structured and unstructured documents of any file type. With its scanning and analysis capabilities, sensitive data protection, and automated data extraction, Hyarchis Data Integrity helps organizations maintain data consistency, security, and regulatory compliance.

Data integrity is like a seatbelt for your sensitive information – it may not be glamorous, but it can save you from a lot of pain and trouble down the road.

Want to know more?