Hyarchis helps you

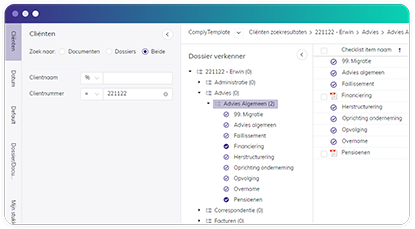

Manage your archive

Get the most out of your digital archive. Storing, retrieving and sharing of data is now quick and easy. The result: your customer data is more accessible and archive management takes a fraction of the time.

Learn moreStay compliant

Verify the accuracy of customer data, perform PEP and sanction checks and store customer data in a secure manner. A structured process reduces the risk of fines and reputational damage.

Learn moreGet to know your customers

Hyarchis helps you stay in control during the entire customer journey. From onboarding to monitoring and remediation: you know who your customers are and can serve them better.

Learn moreKey benefits

Work more efficiently

Our solutions help you to automate manual processes. This saves time and money and reduces the chance of errors.

Avoid fines and reputational damage

We keep track of changes in legislation for you. This gives you the certainty that you always comply with the requirements of supervisors.

Turn data into information

Our applications turn large, unstructured archives and datasets into a source of valuable information. You will gain a better insight into your customers.

Client testimonials

More interesting posts

Want to learn more about Hyarchis?

Book a demo to explore our solutions and discover the benefits it can offer to your business.

Book a demo